Gold in the Emerge-Tech Category!

24/08/2021Guest post written by Becca McDonald, eCommerce Worldwide

The German eCommerce market shares many similarities with other mature markets in Europe. Current strategic discussions predominantly concern the same topics that are also at the center of other advanced-commerce ecosystems, such as the UK and Ireland. For example; omnichannel excellence, mobile first, social commerce, big data and changing customer expectations. However, there are some key differences that any merchant or service-provider should consider before launching into the German market, writes Becca McDonald of eCommerce Worldwide

The eCommerce Landscape in Germany

-

German customers are used to ordering with open invoices as the payment method. Returning items they don’t like or that don’t fit must be easy and for free. As a matter of fact, return rates can exceed 40% depending on the industry segment. However, on the upside, conversion rates when offering open invoices often outperform the European average, thus compensating or exceeding the return effect.

-

The German customer tends to be much more sensitive than their European counterparts when it comes to data protection. This is also reflected in a rather strict legal framework. Likewise, gaining the German customer’s trust is not a given. Businesses need to diligently check their website with regards to spelling and overall professional appearance. Trust symbols might help if brands are totally unknown or reputation still needs to be built up.

-

German businesses, such as Zalando, have set a high service standard – e.g. 100 day free returns – which domestic online customers now expect from any online vendor.

-

For flexible parcel deliveries, Germans are more likely than other European markets to choose a parcel locker solution, such as Deutsche Post DHL’s Packstation, as their preferred delivery location.

-

Special promotion days: ‘Mother’s Day’ in Germany is on the second Sunday of May, as opposed to the English equivalent in March. ‘Black Friday’ has recently gained prominence, with the first dedicated sale activities taking place in 2014.

-

English proficiency is not as widespread as one might expect – Germany only ranks 10th in a European comparison, with countries such as Poland or Estonia ranking higher. Thus, localised German language along all customer communication touchpoints is crucial.

Whilst these points are important considerations for a successful digital launch into the German market, the size and expected growth of the opportunity make it a worthwhile consideration for any merchant with plans to expand their cross-border trade in Europe.

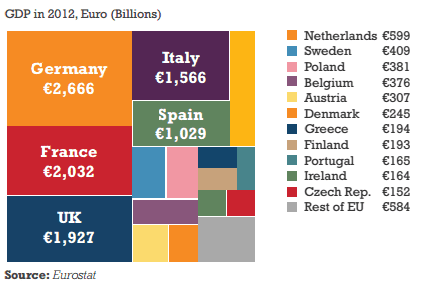

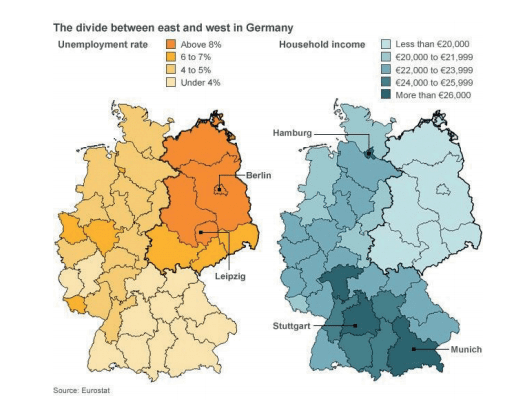

Germany is Western Europe’s largest country, with a population of 81 million. As a country it has a strong history in manufacturing, particularly of high quality products at the leading edge of technology. This is reflected in global brands in medicine and healthcare, chemicals, transport and logistics, automotive and aerospace engineering, pharmaceuticals, technology and innovation, energy, environment and financial services. Germany has the largest economy within the EU, running at circa €2,666bn, but as the following graphics show, there is still an east / west split in terms of prosperity and opportunity. The states in the east of the country, the former German Democratic Republic (GDR), still haven’t gained the full potential of post-unification which took place in the 1990s.

German Economy is the Largest in the EU

The Federal Republic of Germany is a parliamentary democracy which has been stable for over 60 years and, since reunification, consists of 16 states. Local or state level government has a major part to play in the overall governance of the country, whilst at the federal level most ministries are based in Berlin. Though there are still a few based in the former capital, Bonn (pre-unification). A constitution is in place and is referred to as the Basic Law. This defines Germany as a constitutional, federal and welfare state.

Germany is a country of 5,700 towns and cities but only 3 have populations of more than one million (Berlin, Munich and Hamburg). Only 81 conurbations have more than 100,000 inhabitants and of the total population, 37 million people (45% of the total population) live in 300 cities.

Further insights on the German eCommerce landscape can be found here.