2019 US eCommerce Market Report

23/08/2021

Bad Data is Expensive!

14/09/2021The US on a Global eCommerce Scale

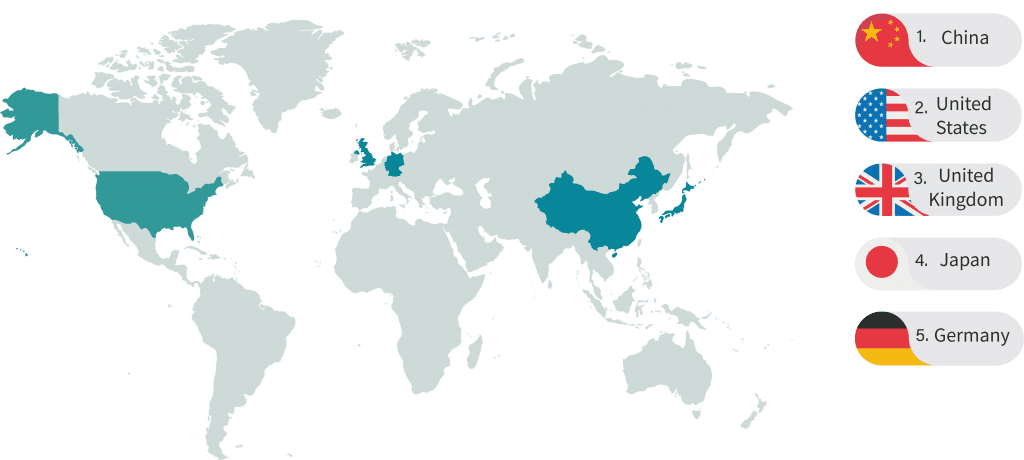

The United States is currently the second largest eCommerce market globally in terms of revenue generation, with China taking first position. This may seem surprising, however it’s estimated that in 2019 alone, Chinese shoppers will spend $2 trillion online, with retail sales set to bypass those made in the US by more than $100 billion. Based on this fact, it’s no wonder that China’s eCommerce market has surpassed the US; not to mention the fact that China’s population also exceeds the US by 1 billion.

Here’s how the global eCommerce landscape looks at the moment based on market value:

Internet/Mobile Usage

In 2000, less than 50% of US adults were using the Internet – today, 9 out of 10 US adults are using the Internet. According to Statista, the household adoption rate of Internet in the US has seen a dramatic increase between 1997 and 2011, jumping from 19% to 72%. Internet usage is most ubiquitous among young adults, college graduates, and those from high income households. This means that the number of homes with broadband varies depending on different demographic variables.

Mobile usage has also seen incredible growth in the US within the last number of years – in fact, mobile internet consumption has grown by more than 500% since 2011 alone. More than half of all video streaming comes from mobile devices, and US consumers spend 90% of their time on mobile using downloaded apps. With consumption commonly occurring between multiple devices, it’s also no surprise that 76% of US consumers use their phones simultaneously while watching television.

US eCommerce Market

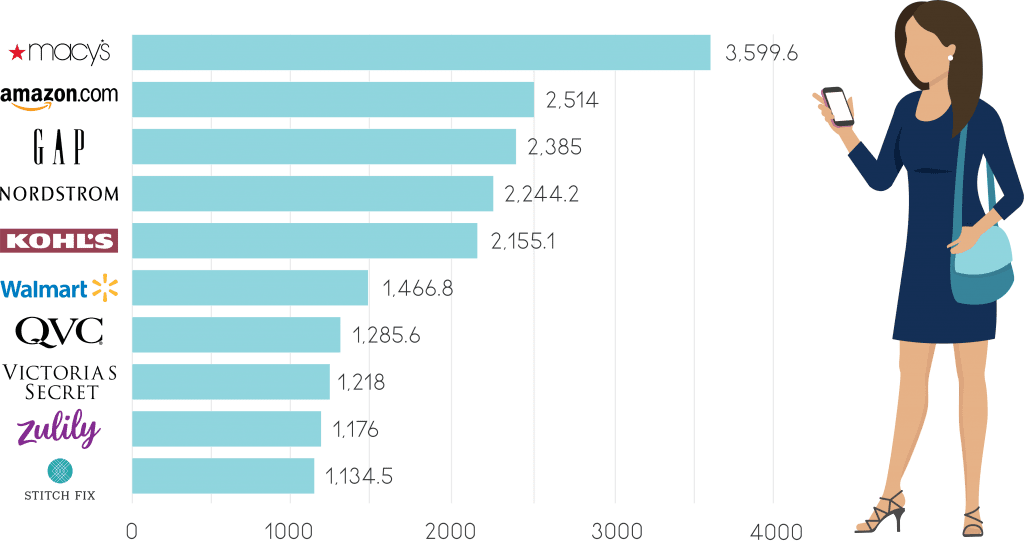

Currently, eCommerce is valued at $520 billion in the United Sates, with retail accounting for more than 90% of that figure. The US market’s largest segment is fashion, with a value of $103B. User penetration is currently at 80% and is expected to hit 83% by 2023. The average revenue per user (ARPU) currently amounts to $1,388.73, and this figure is still growing. In 2018, the most popular website was Amazon, which generated $63 billion in online sales of physical goods in the US alone. In fashion, Macy’s came out on top after generating $3.6 billion in online sales – however, Amazon came in at no. 2 with $2.5 billion. Here’s the breakdown of the top 10 US eCommerce retailers within the fashion segment in 2018 (measured in millions US dollars)

Despite such exponential spend online, there are still two sides to the eCommerce coin – it’s estimated that 3/4 of shoppers choose to leave a website without completing a purchase – in other words, they abandon their cart. This can be further broken down into 4 main reasons: shipping costs were too high, the discount code the shopper had did not work, the order would take too long to ship, the shopper had to re-enter their credit card information again, and the shopper had to re-enter their shipping information again.

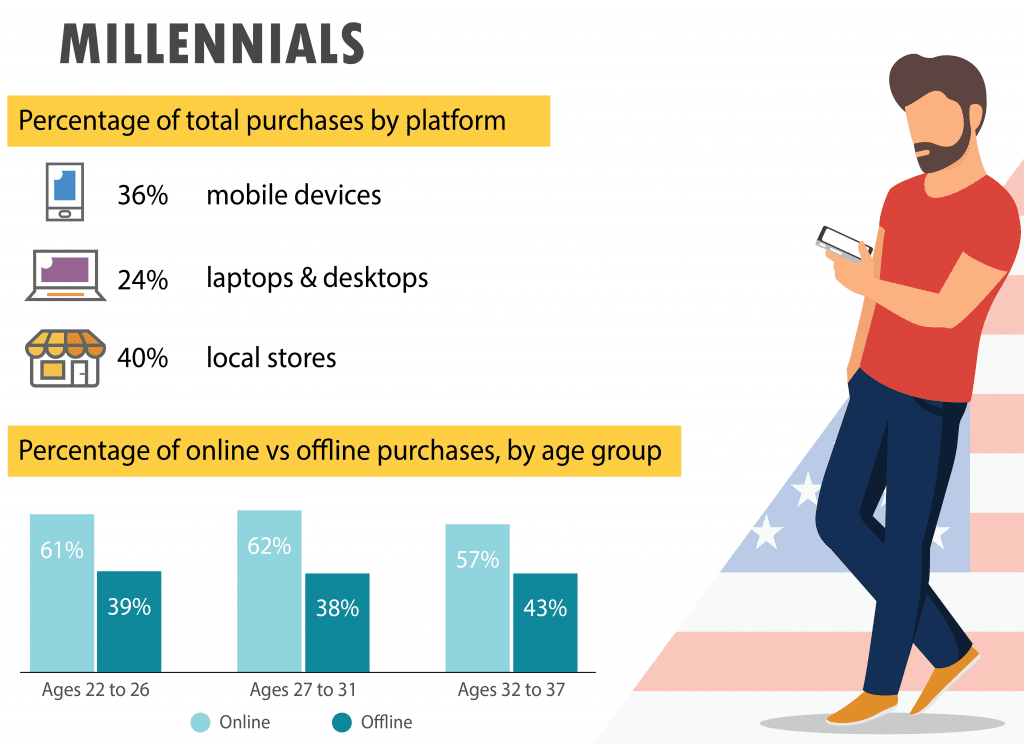

What’s interesting is the number of millennials who still shop in-store as opposed to online; the breakdown is just 60% vs 40% between online shopping and local stores (the 60% is further broken down into laptops/desktops (24%) and mobile (36%). Some of the reasons for millennials preferring to shop in local stores include: having to wait for products to be delivered when ordered online, and not being able to see, hold or try on items before buying when done so online.

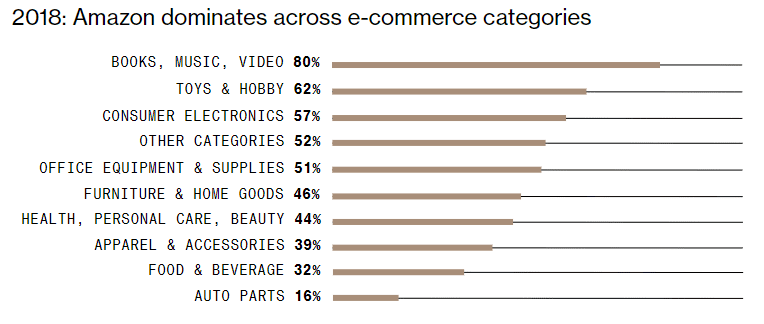

The Amazon Takeover

While Amazon has 4% of the total global retail market, its share in the US alone is at almost 50%. It’s currently the second largest employer in the United States and traffics more than 1/3 of all retail products bought or sold online. Some critics have emphasized the importance of recognizing Amazon’s clout, as online spend is growing at triple the pace of overall retail. This is further supported by the fact that at least 95 million of US shoppers have an Amazon Prime account (to put this into perspective, that’s more than the entire population of Germany!) The retail giant also launched its counter pick-up service in June (where shoppers can have their orders delivered to partner stores), and has recently (and rather strategically) added thousands of new pick-up locations around the country…right in the middle of Q4, the busiest online shopping period of the year.

Amazon currently experiences monthly website traffic volumes of up to 200 million in the US alone, which isn’t surprising considering the sheer success that the company has experienced over the last number of years. However, it has also experienced some very heavy criticism, especially from politicians in recent times. Senator Bernie Sanders said of Amazon earlier this year: “Five hundred thousand Americans are sleeping out on the street, and yet companies like Amazon, that made billions in profits, did not pay one nickel in federal income tax”. Although the company saw a massive profit increase in 2018, it will actually receive a tax rebate of $129 million this year.

Download the full US market report – get insights on top shipping, payment companies, reasons why people abandon carts in US and more.

Outlook for the US eCommerce Market

The US eCommerce market, most notably Amazon, is having a big impact on the high street and it is expected that this year, over $365B will be generated in online sales. It’s also expected that 2020 will have an annual growth rate (CAGR 2019-2023) of 11.6%, resulting in a market volume of $565B by 2023. It’s also thought that 90% of all sales will happen online or by mobile by 2050, and in 2020, we will continue to see large high street retailers closing as Amazon wins more eCommerce market share and more users continue to shop online.