2019 US eCommerce Market Report

23/08/2021

Bad Data is Expensive!

14/09/2021Global Lockdown; Global Recession

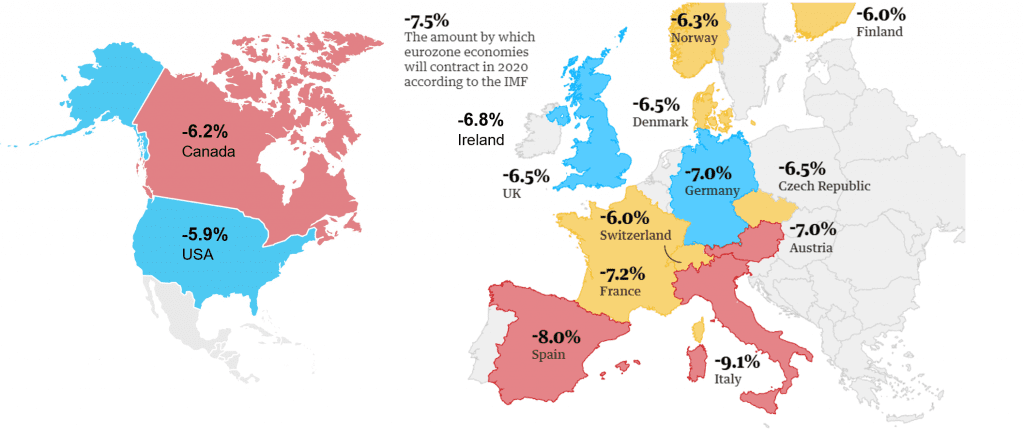

With country leaders around the world imposing lock-down measures and permitting only businesses that provide ‘essential services’ to operate, retailers have ‘closed up shop’ until further notice. It remains uncertain how long this pandemic will last and there is already talk of a global recession occurring as a result. The International Monetary Fund (IMF) recently published its World Economic Outlook for 2020 and 2021, and unsurprisingly, claims that: “The global economy is projected to contract sharply by –3 percent in 2020, much worse than during the 2008–09 financial crisis. Just look at USA which will contract by over 5.9% and in UK this is worse at 6.5% contraction.”

It’s Bad News for the High Street Retailers

Last November we published an article about the threat of Amazon to retailers, mentioning Primark as one of the few ‘untouchables’ against the marketplace giant.

“Going online would have a negative impact on its [Primark] business model. Fulfillment, website hosting & payment gateway capabilities are just some of the costs that would quickly incur for the fashion retailer, which would in turn offer meagre profit margins due to its competitive pricing strategy.”

No boardroom could have foreseen the devastating impact that the Covid-19 pandemic would have on Primark’s revenue, after the retail giant was forced to close all 376 of its stores in March – the company is now set to lose £500M in sales per month and has already written off £284M worth of stock. Other retailers feeling the pressure of the Covid-19 outbreak include Debenhams, Cath Kidston, Oasis and Warehouse which have all recently filed for administration. While Debenhams aims to reopen as many stores as possible, Cath Kidston has no plans to reopen any of its 60 stores, with more than 900 staff losing their jobs. Arcadia Group, parent company of fashion brands including TopShop, Miss Selfridge and Dorothy Perkins has also raised questions over its ability to survive the Corona crisis after recently implementing a pay freeze on pension schemes and seeking rent cuts from landlords.

eCommerce Retail is Booming

Grocery is one of the few sectors that remains open for business, with retailers experiencing a record breaking spike in turnover – March had the biggest month of grocery sales ever recorded in the UK. However, as more people are now staying at home, Supermarket resources are being pushed to the limit as they struggle to provide enough delivery slots for online orders and click and collect purchases. This means that consumer behaviour is changing and people are now doing their grocery shopping online. In fact, March was the first time in US history that consumers bought more groceries online than in-store.

Q1 of 2020 saw an increase of 20% in eCommerce revenue, compared with 12% during Q1 of 2019. January-March 2020 even outperformed the last quarter of 2019, aka the holiday shopping season. Some of the online retail sectors seeing an unexpected surge in sales include electronics, homeware & DIY, health & fitness equipment and pet food/accessories. Unsurprisingly, many retailers are experiencing issues with their supply chain as they struggle to process the exponential number of online orders. Traditionally, commercial airlines would generate up to 15% of their revenue from cargo, but that percentage has increased significantly since March – Virgin Atlantic recently operated its first ‘cargo only’ flight.

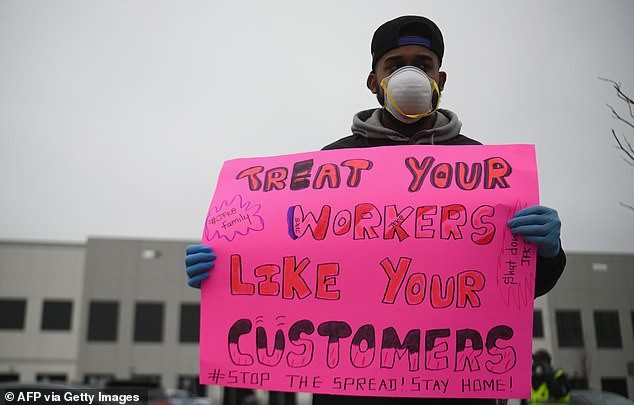

As a result of the global pandemic, Amazon’s stock is set to increase by 20%, accelerating the company’s market value to more than $1 trillion. The eCommerce marketplace is said to be reaching global sales of $11,000 per second, but is scrambling to hire enough staff to cope with the extra demand. However, it’s claimed that workers from more than 50 of the company’s US warehouses are suspected to be infected by the virus, resulting in major concerns surrounding social distancing and transmission.

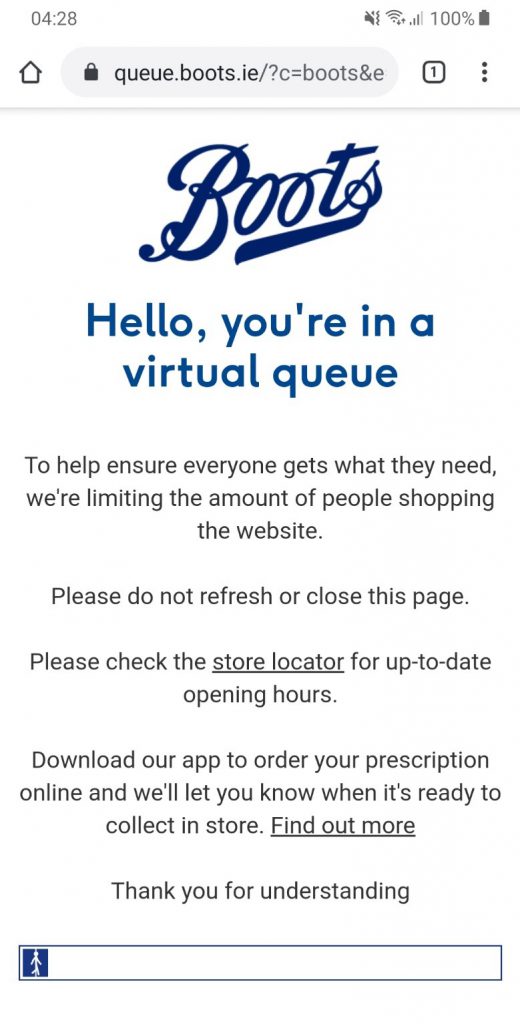

Other eCommerce retailers are also struggling to manage the sheer volume of online orders; in an unprecedented response to the growing demand, Boots and B&Q were just two companies that implemented a queueing system to access their website. Next, which had ceased online operations due to the virus outbreak, reopened its website in late April, only to reach a self-imposed daily limit of orders within a few hours. In a bid to combat bandwidth issues, German based eCommerce personalisation company commercetools has launched a new product, Accelerator, to support etailers by implementing enterprise level applications on their eCommerce sites within only a few weeks source – the tool is designed to help companies meet the demand and peaks in online ordering.

eCommerce Services Sharing in Covid-19 eCommerce Success

It’s clear that online retail is experiencing huge growth during the Covid-19 pandemic, and the same can be said for several sectors within the Digital Goods industry. More time spent at home means more time watching television, connecting with family members through virtual chat platforms, and streaming music/films. In the first quarter of 2020, Netflix gained nearly 16 million new subscribers, resulting in a 22% increase YoY. Video conferencing platform Zoom has also seen a significant increase in its user base, reaching 300 million users by mid April. eLearning is another sector which is thriving, as many schools and colleges around the world have been forced to continue with curriculums in a virtual capacity.

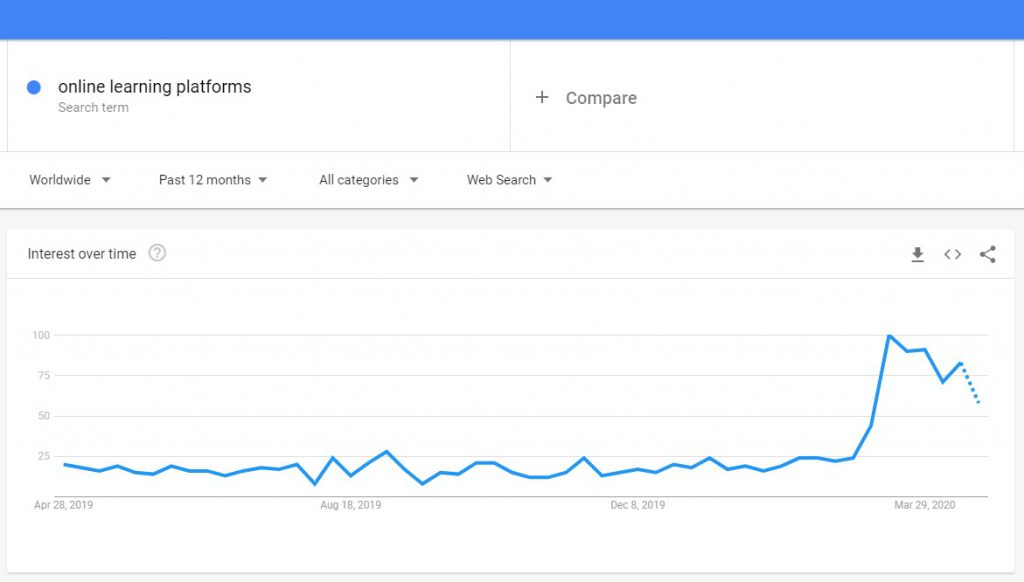

Thousands of organisations around the world are in a similar situation as they make the arduous transition to remote working. In March alone, people development solution company Cornerstone reported a 6x increase in the number of hours spent on its platform. Google Trends has also reported a significant spike in search interest for the term: “online learning platforms” between mid-March and April.

Travel, Hospitality and Ticketing Sectors Suffer

Despite many eCommerce services thriving during the global lockdown, several sectors are going in the opposite direction. As country leaders around the world enforce the closure of ‘non-essential’ businesses, the impact has resulted in pubs, restaurants and hotels closing their doors – something that has not happened since the War. This also means that no mass gatherings can take place, and thousands of events have been postponed and cancelled. In the UK, nearly 30,000,000 music fans attended live events during 2018, which means that companies such as Ticketmaster, Live Nation and S.J.C are all set to experience dramatic revenue losses in the months ahead. Major sporting events including the Olympics and Euro 2020 have also been postponed until 2021, while Wimbledon has been cancelled.

The outbreak has also affected the hospitality industry hugely, with a predicted 65% drop in hotel reservations. Online booking engine Expedia has recently raised $3.2 billion to help strengthen its balance sheet in response to the significant decrease in number of people travelling. Netherlands-based company Booking.com has also been massively affected by the pandemic and has sought financial help from the Dutch Government.

Where Should Businesses Targeting eCommerce Focus Their Efforts?

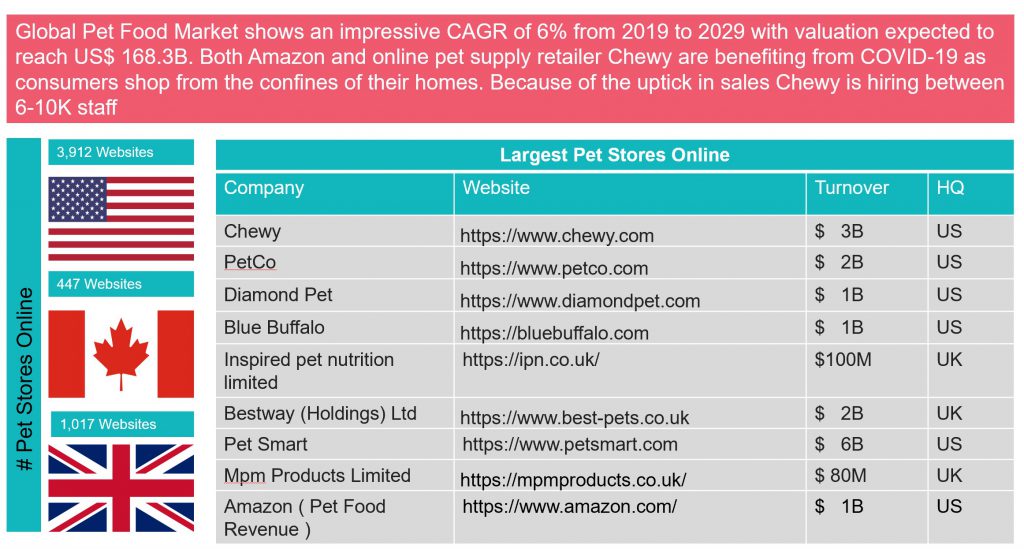

Covid-19 is having a devastating impact on businesses around the world, yet eCommerce has inadvertently capitalised as a result. Based on a deep dive analysis by our data team, TAMI has identified the major growth areas within eCommerce industries in the United States, United Kingdom and Canada. The following sectors are lucrative business opportunities for companies interested in targeting eCommerce merchants, based on consistent growth patterns that we’ve seen: DIY, Home Furniture & Furnishings, Pharmaceutical, Medical Devices, Fashion, Cosmetics, Car Parts, Food & Drink, Pet Food Accessories, Consumer Electronics, Online Gaming, Video Conferencing, Video streaming, Sports Equipment and clothing, Vaping, Online Learning and Books.

Below is an example for Pet Food:

We help companies to size their entire market opportunity and find all of the leads for their Sales teams through our analysis of the Internet. We identify where they should focus their efforts to generate the most revenue and ensure that the companies they target are the right ones. We know the eCommerce industry better than anyone else. Please get in touch if you would like to know more: hello@tami.ai.