The New Rules of B2B Content Marketing: 10 Tips for Building Trust

12/12/2025

TAMI vs ZoomInfo Chrome Extension: Which Is More Accurate?

12/12/2025Competitive intelligence software has moved from a niche category to a daily requirement for B2B teams. The pace of competitive movement, product releases, and market change keeps accelerating, and internal teams can no longer track it manually.

Reliable intelligence has become the difference between strategies that stay relevant and strategies that collapse under outdated assumptions. This shift explains why market intelligence tools, sales enablement software, and B2B data analytics are now woven directly into revenue planning rather than treated as side projects.

Why competitive intelligence software matters more in 2026

The buying journey has changed again. Decision-makers compare more vendors in less time, and competitors iterate faster. This puts pressure on teams to understand what buyers care about right now rather than six months ago.

Competitive intelligence software helps bridge this gap by giving teams a current and detailed view of their environment.

However, not all tools perform equally well. Many rely on large but outdated datasets, which leads to inaccurate assumptions in targeting and segmentation. This is why companies increasingly use platforms like TAMI to clean, verify, and refresh their core data before drawing conclusions from it. A clean data layer makes every other tool sharper.

Data accuracy and B2B growth decisions

If the baseline data is wrong, the strategy built on top of it will be wrong. Many teams discover this the hard way after spending months creating content, campaigns, and outreach based on incomplete insights.

Inaccurate firmographic details, old technology signals, and inactive domains can skew an entire go-to-market plan.

Competitive intelligence software must therefore prioritise accuracy. TAMI addresses this by updating CRM data in real time, verifying contact information, flagging job changes, and removing dormant companies from your targeting mix.

This reduces wasted outreach and improves the quality of both inbound and outbound programs. It also helps teams avoid misinformed strategies that looked good on paper but never aligned with market reality.

How technology tracking improves competitive clarity

Technology choices reveal a lot about a company. They signal growth, investment priorities, operational maturity, and even churn risk. This makes technology tracking an essential feature of modern competitive intelligence software. Tools like BuiltWith and Wappalyzer have been used widely, although teams often report inconsistencies in accuracy.

The problem is not the concept. The problem is the dataset.

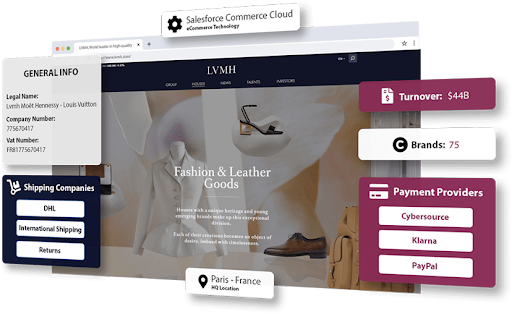

TAMI improves this by validating technology stacks with far greater precision, removing duplicate domains, and filtering out inactive websites. When your technology data is correct, your competitive insights become far more dependable. Sales teams can prioritise accounts realistically, and marketing teams can build segments based on accurate adoption signals.

Making sense of competitor movement in real time

Even with good data, competitive intelligence still requires monitoring. Companies change pricing, rewrite messaging, release features, and expand into new markets.

Tools like Crayon help track these shifts, while Semrush offers clarity on search visibility and content performance. These signals are useful, but only when tied back to a reliable dataset.

A practical approach is to use these platforms in combination with TAMI. One tool tracks digital changes, the other validates whether those movements reflect real company behaviour or internal restructuring. This prevents teams from reacting to noise and helps them make decisions anchored in accurate, up-to-date market information.

Strengthening sales enablement with verified intelligence

Sales enablement software has become a natural partner to competitive intelligence. Reps need guidance that reflects what is happening in the market today.

Platforms like Highspot and Seismic help organise content, present insights, and support conversations around competitors. Their impact improves significantly when paired with accurate data.

However, the strength of any sales enablement platform depends on the quality of the data it receives. If contact information is outdated or if the target list is off, even the best competitive guidance will fall flat.

TAMI fixes this by refreshing contact data automatically and validating whether prospects are active, engaged, or recently moved roles. This way, reps can focus on conversations that matter instead of chasing inactive accounts.

Why modern segmentation relies on cleaner intelligence

Modern B2B segmentation goes far deeper than industry and company size.

Teams want to segment by technology adoption, cross-border activity, merchant size, partner relationships, and dozens of other factors. Many tools claim to offer this, but segmentation breaks down when the firmographic foundation is inaccurate.

TAMI’s patented merchant detection and AI-driven industry mapping strengthen segmentation by identifying companies more accurately than traditional datasets. This helps teams avoid targeting the wrong industries or overcounting markets.

Once the foundation is correct, competitive intelligence software becomes significantly more powerful because the context is accurate.

How competitive intelligence software directly supports revenue

Competitive intelligence software like TAMI influences revenue in ways that are easy to measure once teams start using it effectively.

Win rates rise when sales reps know exactly which competitors they are up against. Messaging improves when marketing teams understand how competitors position themselves. Customer targeting becomes sharper when segmentation reflects the real market.

TAMI adds another layer by identifying competitor customers, revealing partner choices, and updating CRM records the moment changes occur. This helps teams pursue higher value accounts, prioritise expansion targets, and build competitive plays based on facts rather than guesswork.

Choosing software that produces reliable outcomes

The best competitive intelligence tools share one trait. They provide a clear and accurate picture of the market.

Flashy dashboards matter less than reliable data. Companies should look for tools that maintain data quality, deliver real-time intelligence, and integrate seamlessly with their existing systems.

The strongest results happen when competitive intelligence software is paired with a clean, verified data foundation. This is why companies that take intelligence seriously begin by improving the accuracy of their data using platforms like TAMI, then layer on additional tools for monitoring, messaging insights, and sales enablement.

Final thoughts

B2B growth in 2026 rewards companies that operate with clarity. Competitive intelligence software provides that clarity, but only when supported by accurate data and tools designed for real-time change. Teams that invest in clean intelligence reduce risk, increase revenue predictability, and build strategies that stay aligned with the market.

If you want to strengthen your competitive intelligence stack and work with data you can trust, sign up today and see how TAMI supports fast, confident B2B growth.