Email Blacklist: Understanding and Avoiding Email Deliverability Issues

11/04/2023

Embracing the Future: Enhancing E-commerce with Cutting-Edge Martech Solutions

09/05/2023Buy Now Pay Later (BNPL) services have gained much popularity over traditional credit cards, especially as countries suffer high inflation and move closer to recession. BNPL, as a payment option, allows customers to purchase items and pay for them in instalments, often interest-free. In the United Kingdom, the use of BNPL services has risen by 39% in the past year alone, according to a report by The Guardian.

UK BNPL Legislation

The UK government has unveiled draft legislation to bring the rapidly expanding ‘buy now, pay later’ (BNPL) sector under the Financial Conduct Authority’s (FCA) regulatory oversight, strengthening consumer protection measures. The draft legislation results from a two-year consultation process presented by the UK Treasury, which seeks to grant the FCA authority to regulate companies offering specific interest-free instalment credit options to consumers. This move addresses growing concerns about potential consumer harm from the unsecured credit market.

Currently, most BNPL firms and their products operate outside regulatory purview, leaving borrowers needing the consumer protections typically incorporated into regulated consumer lending products. If the proposed regulatory framework is implemented, BNPL providers would need authorization from the financial regulator and adhere to various regulatory requirements and consumer credit rules, such as the forthcoming Consumer Duty and financial promotions regime. In rule violations, the FCA would possess the power to enforce corrective actions against the offending firms.

However, like any financial product, BNPL services have pros and cons, and it is essential to understand them before deciding whether to use them.

Pros of BNPL Services

- No Interest Charges

-

- One of the most significant advantages of BNPL services is that they are often interest-free, meaning that customers can spread the cost of their purchases without paying extra fees, which is particularly beneficial for those who want to avoid financial debt.

-

- Another advantage of BNPL services is that they are straightforward to use. Many retailers now offer BNPL as a payment option at checkout, making it a convenient choice for consumers who want to avoid the hassle of applying for a credit card.

- Flexible Payment Terms

-

- BNPL services often offer flexible payment terms, allowing customers to choose the instalment plan that best suits their needs, which means that customers can pay for their purchases over a more extended period, making it easier to manage their finances.

- No Impact on Credit Score

-

- Using a BNPL service does not usually impact a customer’s credit score, assuming they pay on time; however, many BNPLs make money out of late payment fees.

Cons of BNPL Services

- Late fees and charges

-

- While BNPL services may be interest-free, they often come with late fees and charges. If a customer misses a payment, there are often high-interest payments on the overdue amount, which can quickly add up if they cannot make the payment.

- Temptation to Overspend

-

- One of the most significant drawbacks of BNPL services is that they can tempt customers to overspend. With the ability to buy now and pay later, it can be easy to make purchases beyond one’s budget, leading to financial problems.

- Limited Protection

-

- Compared to credit cards, which offer robust consumer protection, BNPL services may provide a different level of security. If a customer experiences issues with a purchase, they may have various rights to dispute the transaction than they would with a credit card.

- Impact on Credit Score

-

- While using a BNPL service may not impact a customer’s credit score, missing payments or defaulting on a payment plan can severely impact their credit rating, making it harder to obtain credit in the future and may result in higher interest rates.

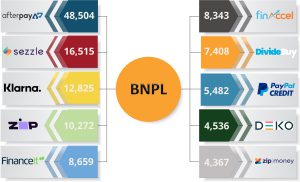

TOP 10 BNPL Companies

The top 10 companies in the BNLP space, along with the number of online retailers they serve, are as follows:

- Afterpay: With 48,504 online retailers using their services, Afterpay is a leading BNPL provider known for its simple and transparent payment plans, which allow customers to split their purchases into interest-free instalments.

- Sezzle: Serving 16,515 online retailers, Sezzle is another prominent player in the BNPL market. Their platform lets customers pay for their purchases in four interest-free instalments over six weeks.

- Klarna: Working with 12,825 online retailers, Klarna is a well-established BNPL provider that offers various flexible payment options, including interest-free instalments, pay later, and financing options.

- Zip.co: Collaborating with 10,272 online retailers, Zip.co, provides customers with a digital wallet allowing flexible, interest-free payments on purchases made at partnered retailers.

- Financeit: With 8,659 online retailers, Financeit offers point-of-sale financing options for consumers, enabling them to pay for purchases over time with affordable monthly payments.

- Finaccel: Serving 8,343 online retailers, Finaccel’s primary product, Kredivo, provides customers in Southeast Asia with flexible BNPL options and instant credit.

- DivideBuy: Partnered with 7,408 online retailers, DivideBuy is a UK-based BNPL provider allowing customers to split purchase costs over several interest-free instalments.

- PayPal Credit: With 5,482 online retailers offering their services, PayPal Credit enables customers to make purchases on credit and pay for them over time, either through interest-free instalments or with interest added after a promotional period.

- Deko: Working with 4,536 online retailers, Deko offers a platform that provides various consumer finance options, including BNPL plans and retail finance solutions.

- Zip Money: Serving 4,367 online retailers, Zip Money is an Australian BNPL provider that enables customers to access interest-free credit for their purchases with flexible repayment options.

These companies showcase the diversity and reach of the BNPL market, providing customers with convenient and flexible payment options to meet their individual needs.

In conclusion, BNPL services can be a valid payment option for those who want to spread the cost of their purchases. TAMI, a market intelligence and sales lead generation company, can help BNPL companies connect with their ideal customers, thereby driving customer acquisition and growth. By employing TAMI’s expertise, BNPL providers can ensure they reach the right audience and continue to expand their user base in an increasingly competitive market.