2019 US eCommerce Market Report

23/08/2021

Bad Data is Expensive!

14/09/2021Buy Now Pay Later (BNPL) services are becoming more and more popular with people shopping online. Did you know there are 75K eCommerce websites in the UK where consumers can buy now and pay later? Here are some of the major brands now offering this service Asos, JD Sports, Marks and Spencer, Manutd, Arsenal.

BNPL is sweeping across the internet. It is so simple. When shopping online the price of a product can sometimes discourage us from clicking the buy button. Perhaps, you don’t have the money available at the time or simply you want more security knowing that you don’t have to pay a smaller or less known seller upfront. Instead of using a credit card and having to pay interest fees, BNPL services like Klarna charge no interest fees on the consumer, but the retailer gets charged a transaction fee instead.

With ecommerce still rapidly growing, consumers are trying out different methods of purchasing online. Consumers want the easiest and most convenient way of payment. Due to Covid-19 a lot of consumers got comfortable with online shopping and a recent insight predicts that 20-30%1 of the Covid-19 related shift to the digital world will be permanent. This is good news for digital payment providers.

The Downfall of Cash

Even before Covid-19 cash was starting to move from people’s wallets onto digital platforms, the pandemic only escalated this. The world is working harmoniously in getting rid of cash, with multiple countries introducing digital wallets, cards, apple watch and mobile apps as countries like Sweden are encouraging ‘touch and go’ payments. A lot of Swedish retailers do not accept cash and only 20%2 of all transactions are made in cash. They achieved this by launching free mobile payments app, eliminating ATMs and granting stores the right to refuse cash. There are great benefits to not having to carry cash, transactions have become simple, however, if you are a consumer who doesn’t manage their finances, less cash can lead to more expenditure. It is much easier to tap your card than to break your notes into coins, only to lose or drop them later.

From Cash to Cards to BNPL

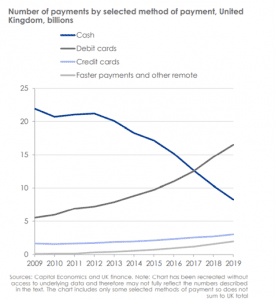

Research3 has shown that since the pandemic 46% of Americans have turned to cashless payments. In Italy cashless payments increased by more than 80% and cash transactions decreased by 50% in the U.K. From all the contactless payments debit cards seem to be winning the digital race. ‘’Debit cards accounted for four in ten payments in 2019.’’

While debit cards are still on the rise, credit cards are not as widely used anymore. They are still used for hefty transactions; however, some digital consumers have started to use BNPL services to replace credit cards. Regarding the U.K. consumers Finder4 states that ‘’in August 2020, 27% of consumers who’ve been using BNPL, or plan to do so, cited not wanting to use or take out a credit cards as a factor in choosing BNPL.’’ Based on a survey5, Capital Economics estimates that 50 million transactions were made using BNPL in 2020, whilst 3.1 billion using the U.K. credit cards. ‘’The number of BNPL purchases is equivalent to 1.6 per cent of the total credit card purchases.’’ This showcases the rising popularity of BNPL.

Predictions for BNPL and its growth

So far BNPL services seems to provide numerous benefits for retailers and consumers. Consumers love BNPL because there is no interest rate like with credit cards. If the number of consumers used credit cards instead of BNPL services in 2020, they would have paid around £76 million in interest fees. BNPL also provides benefits for the retailers. Klarna, one of the leading BNPL service providers claims that it can increase the retailers’ average order by 33%6. Amongst this, it also pays the retailer upfront, so they take no risk if the customer skips a payment. Survey carried out by Finder states that 9.5 million people in the U.K. avoided buying from retailers that don’t offer BNPL services. However, there is a few negatives. If you delay your BNPL payments, there could be financial difficulties. Although, a survey found that 71% of adults that used BNPL hadn’t had any financial issues. Another con is fraud. ‘’It is estimated that the total fraud losses on UK issued debit and credit cards was £620 million in 2019. ‘’ As BNPL belongs in the digital world, it would be no different for it.

BNPL services seem to be gaining a lot of recognition within the digital world. There is no current sign of this changing as there is an increasing number of customers year on year. However, the FCA have lined up BNPL companies into their cross hairs

Financial Regulation UK

The financial Conduct Authority in UK believe it is vital that we have a fair market that works for everyone. New ways of borrowing and the impact of the pandemic are changing the market, with billions of pounds now in unregulated transactions and millions of consumers at greater risk of financial difficulty.

‘Changes are urgently needed: to bring BNPL into regulation to protect consumers; to ensure that there is secure provision of debt advice to help all those who may need it; and to maintain a sustained regulatory response to the pandemic.

UK households have nearly £250 billion of outstanding consumer credit debt and more than 42.5 million people used consumer credit in 2019.

The regulation of unregulated buy-now pay-later: BNPL products which are currently exempt from regulation are to be brought within the regulatory perimeter as a matter of urgency. The use of BNPL products nearly quadrupled in 2020 and is now at £2.7 billion, with 5 million people using these products since the beginning of the coronavirus pandemic. The emergence and expansion of unregulated BNPL products gives consumers a significant alternative to more expensive credit, but this also comes with significant potential for consumer harm. For example, more than one in ten customers of a major bank using BNPL were already in arrears. Regulation would protect people who use BNPL products and make the market sustainable.

Debt advice: The provision of debt advice will be critical to a sustainable market in the long term, especially through the recovery from coronavirus. Free debt advice services need secure, long-term funding as demand increases to as many as 1.5 million additional cases, following the pandemic.

In summary BNPL is here to stay and is a growing trend across the globe however it will be scrutinized more by financial regulators around the globe.

Bibliography

- Mastercard Recovery Insights: E-commerce a Covid Lifeline for Retailers with Additional $900 Billion Spent Online Globally

- How India can become a cashless economy – BusinessToday

- Will cash be on permanent lockdown because of COVID-19? (digitalcommerce360.com)

- Finder, Amelia Glean, Finder, ‘Instant hit: The rise and rise of buy now, pay later, August 2020’, (accessed 27 January 2021).

- PowerPoint Presentation (klarna.com)

- Klarna: The rise of ‘buy now, pay later’ – CNN