Gold in the Emerge-Tech Category!

24/08/2021Introduction

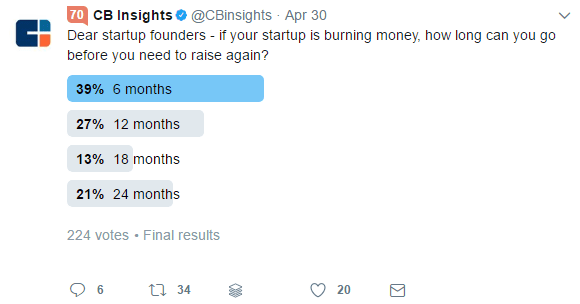

CB Insights recently asked the startups of Twitter how long they could last if the company was burning money. Out of 224 respondents, 39% stated that they had less than 6 months’ worth of cash remaining to run their business. In fact, ‘running out of cash’ is considered to be one of the most common reasons why startups fail. This very real problem got me thinking about the difficulty that entrepreneurs face in setting up and running their business for the first couple of years, so I decided to share some tips on how to fund your business until your company is ready for venture capital investment.

1. Bootstrap Your Company

Tap into savings, home equity, or family loans. I know it may be risky, but you can’t expect others to invest in your company if you haven’t contributed some of your own! Savvy investors want founders to show confidence with their own funds, and they tend to favour entrepreneurs with more than “just” sweat equity in the game.

2. Sales

This is by far the best way to fund your business. The best salesperson should be the CEO; this is your company and your product/service to sell. So don’t be afraid to pick up the phone and start cold calling! I have successfully reached out to CEOs and VPs of global companies and converted this into revenue. Relying on inbound traffic can be quite an arduous process, and you could ultimately run out of money before things start to pick up. Check out lead generation services that can fill your first email campaigns or outbound sales campaigns with high-quality leads similar to ours. For example, we at TAMI provide eCommerce sales leads both for Enterprise Companies and startups.

3. Friends and Family Funding

Consider raising funds from friends and family. In Ireland, the Employment and Investment Incentive (EII) allows individual investors to obtain income tax relief on investments made in your company (subject to certification under EII). You must seek this certification directly from the Revenue Commissioner under the condition that the company has not been operating in any market for more than 7 years following your first commercial sale.

4. Sign up Strategic Partners Early On

There’s nothing sweeter than finding a supplier, distributor, or especially a customer, who stands to gain so much from your solution, that they are willing and able to help foot the bill. For example, one of our customers became a partner and now we’re seeing the green shoots of revenue coming in.

5. Banks

Debt funding is notoriously difficult to secure for startups. Find the bank in your locality that supports early-stage companies. In Ireland, a good one to consider is AIB which provides a range of services from:

a. Startup loans up to 100K at a reduced rate

b. Asset financing

c. Bank overdrafts

d. Business credit cards

e. Expertise

6. State Funding

In Ireland, there are two main types of funding:

Local Enterprise Offices (LEOs) provide a range of financial supports designed to assist with the establishment and/or growth of enterprises (limited company, individuals/sole trader, cooperatives, and partnerships) employing up to ten people.

Enterprise Ireland runs a Competitive Startup Fund (CSF), where you have the opportunity to win €50,000 in investment. This is followed by High Potential Startup Funding (HPSU) where EI can invest up to €250,000 in follow-on investment (subject to match funding by a VC or private investor).

7. Tax Refund – Research & Development Credits

This is a great way to fund your startup if you’re involved in Research and Development. The Irish Revenue reissued concessional treatment for R&D tax credits in February 2017. This concessional approach means that the Revenue, as a rule, will not seek to challenge the scientific/technical merits of any claim where the following conditions are met:

a) An Enterprise Ireland or IDA R&D grant was received in respect of a project

b) The R&D tax credit claimed in any given period is €50,000 or less (this equates to a claim containing less than €200,000 of R&D expenditure)

c) The company is a small or medium enterprise (SME)

In Ireland, the R&D tax credit regime is not being utilised to its full effect by startups or SMEs. The Department of Finance Report on Tax Expenditures in October 2016 reported that two years previous, only 24% of the repayable credit was paid to firms with fewer than 250 employees.

This regime can be invaluable to your startup, as it offers companies a 25% tax credit on expenditure on R&D in addition to the 12.5% corporation tax deduction. This 25% credit can be offset against corporation tax liabilities, or alternatively, received as a cash refund (subject to certain criteria). Find a company that can process the application for you. We use Mazars, and their services have been excellent.

8. Reduced Tax Bill – KDB

In addition to the R&D tax credit regime, it may be possible for startups to qualify for the Knowledge Development Box (KDB), a new regime effective from January 1st, 2016 that offers an effective tax rate of 6.25% on qualifying profits derived from underlying intellectual property. The KDB regime is very closely tied to the R&D tax credit regime in terms of scientific/technical qualification and, as such, availing of the R&D tax credit is also an extremely useful stepping stone to avail of the KDB.

9. Crowd Funding

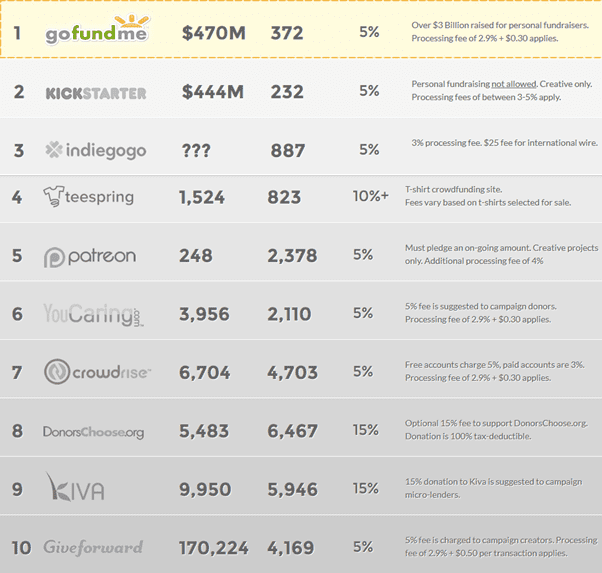

You could also raise funds via cloud funding platforms; check out the company LEAF which raised over $2,000,000 in crowdfunding by allowing their customers to pre-order their product (I actually met these guys last March in Tel Aviv, and their pitch was amazing!) Here are some of the top crowdfunding companies for you to consider:

Source: http://www.crowdfunding.com/

Conclusion

Securing venture capital money is a long and slow process. Typically, VCs look for €100,000+ in monthly recurring revenue. You may be lucky, should this happen in your first year, but for many companies, this happens from year 2 onward…by which time you may have run out of money. My recommendation is to focus on sales as soon as you launch your product. If your product is not market-ready, look to bootstrap or raise funds with friends and families. State funding may appear difficult to secure, however, Enterprise Ireland and Local Enterprise Offices have a variety of funding options that range from €25K to €250K. We have found them incredibly supportive.

I wish you the very best of luck with your startup; if you need help to fill your sales funnel, please don’t hesitate to reach out to us!